Despite ongoing economic and political uncertainty, new data shows stability in how associations view risk around membership models, with most still playing it safe, but some ready to explore change—prompted by board pressure and membership trends.

It’s tough to plan for the future when the present keeps throwing curveballs—political, global, and economic. That uncertainty makes it especially challenging to pursue major changes, like rethinking a membership model. Is now the right time? New Avenue M benchmarking research reveals that despite uncertainty, association leaders remain consistent when it comes to their appetite for risk.

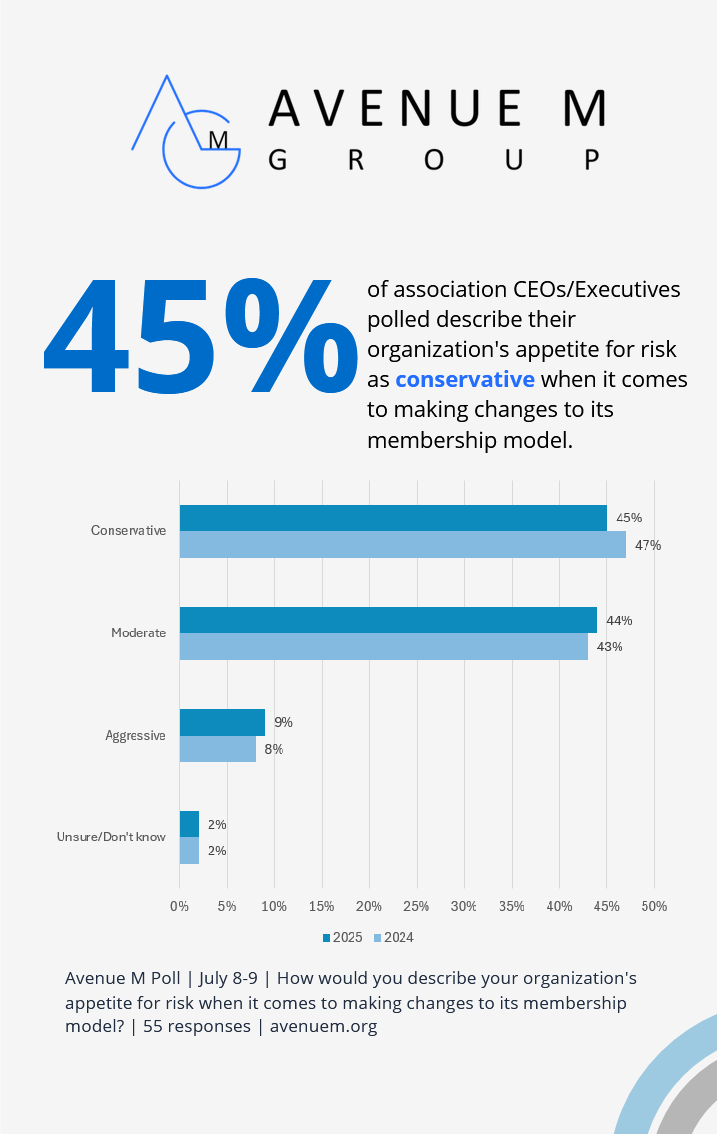

For example, a year ago, an Avenue M quick poll found that nearly half of associations described themselves as conservative when it came to changing their membership models. Only 8 percent identified as aggressive, and many CEOs reported feeling torn between the need to innovate and the fear of disrupting stable revenue streams. Today, that picture is largely the same.

A new, early July 2025 Avenue M quick poll of association executives found that 45 percent still say their organization takes a conservative approach to membership model changes, while 44 percent consider themselves moderate in 2025, and 9 percent now say they are aggressive.

A new, early July 2025 Avenue M quick poll of association executives found that 45 percent still say their organization takes a conservative approach to membership model changes, while 44 percent consider themselves moderate in 2025, and 9 percent now say they are aggressive.

The organizations that say they are more conservative about change explained that dues are a major revenue source; board oversight makes change slow; and growth—even if incremental—makes it hard to argue for risk.

As one executive noted, “Membership continues to grow, but it really needs an overhaul. It’s hard to sell change when the numbers are going up.” Another said, “Membership is our second-largest revenue driver. We see better opportunities for growth elsewhere—without touching the model.”

However, even within organizations that have a more conservative stance, there are fissures: new board members pushing for global expansion, declining chapter membership trends, or internal debates about value delivery. “We’re being pushed to be less conservative,” one respondent said. Another warned that chapter struggles might soon force more openness to risk.

Moderate-risk organizations are already feeling that shift. One cited a decline in core membership categories as a wake-up call to evaluate the current structure. Another shared that political volatility—specifically the Trump administration—pushed their organization to act more aggressively than their culture would typically allow.

These emerging signals echo concerns voiced last year, when CEOs reported boards that feared revenue loss, and staff who believed other models could unlock new value. At that time, some were piloting changes—like three-year test programs or incremental adjustments to outdated category structures. Others admitted the intent to evolve was there, but “chapter-national politics” or “friction from too many pricing tiers” got in the way.

What hasn’t changed is the core tension: Associations want to serve their members better and adapt to a changing environment—but risk aversion often stymies them. And yet, as one leader put it last year, “Change is constant, but it doesn’t have to be radical.”

That’s the thread connecting these two polls: Appetite for risk evolves based on leadership, external pressures, internal alignment, and membership data. While there was only a 1 percent growth in those who say they are aggressive when it comes to their organization’s appetite for risk from 2024 to 2025, this slight shift might be a sign that some associations are still willing to rethink what has long been treated as untouchable– even despite the increased economic and political uncertainty.

The takeaway? Associations may not be ready to change overnight, but some are still pushing forward. And in a time of shifting expectations, professional realignment, and new definitions of value, even small steps and a continued willingness toward bolder thinking could make the difference in long-term relevance.

Want to participate in future text polls? You can sign up HERE.

For more insights on organizational risk, read Avenue M’s quick summaries of the following resources, and click the links below.

Risk Appetite Among CFOs Is Down Amid Trade Uncertainty, Survey Finds

A new Deloitte survey shows CFOs are pulling back on risk, with only 33 percent saying it’s a good time to take chances, down from 60 percent last quarter. Uncertainty around tariffs, trade policy, and global tensions has companies in a wait-and-see mode, despite earlier optimism about the economy. Just 23 percent of CFOs now say the economy looks “good,” a sharp drop from earlier this year.

Risk-taking usually means growth—through new investments, acquisitions, or expansion—but many CFOs are hitting pause. Top concerns include the economy, cybersecurity, and interest rates. With fresh tariff threats and no clear policy direction, the path forward feels even less certain. This is relevant for associations because these shifts in risk appetite and economic uncertainty directly affect their members’ businesses and industries, influencing everything from investment decisions to workforce stability.

6 Strategies Great Leaders Use to Lead Through Economic Uncertainty

Economic uncertainty is tough on frontline employees who face stressed customers and shifting organizational rules, making strong leadership more important than ever. Since frontline leaders manage most employees, how they guide their teams affects both morale and how well the organization weathers challenges. Good leaders balance business needs with real care for their people, helping teams stay focused and resilient.

To lead well in uncertain times, leaders need to be clear and honest, drop the need for perfection, and recognize that different team members may need different kinds of support. Checking in regularly, encouraging new ideas, and making decisions based on real data all help teams adapt and stay strong, setting the organization up to handle whatever comes next.

AON’s CEO Sees Huge Potential in These Four (or Five) Megatrends

Greg Case, CEO of AON, says four major forces—trade, technology, weather, and workforce—are reshaping how organizations operate. But it’s not just each trend on its own that’s challenging—it’s how they overlap. For associations, this means navigating shifting member needs, rapid tech changes, climate-related disruptions, and talent shortages, often all at once. The real risk comes from how these issues combine to create bigger, faster-moving challenges.

Case gives the example of extreme heat affecting construction projects—not just a climate issue, but a workforce one too. Associations face similar overlaps: Climate change may impact industry standards, while workforce gaps could reshape training and certification programs. The takeaway? Associations can’t tackle risks in silos. They need to see the full picture and stay flexible as these forces continue to collide.

Want to be the first to be notified about articles like this? You can learn more about Avenue M’s texting poll service HERE.

Contributors: Sheri Jacobs, FASAE, CAE & Lisa Boylan

Image: Adobe Stock